NFTs are creating a new market by adding unique value to digital data that can be easily duplicated using blockchain technology. There have even been recent cases of digital art and text posted on social networking sites being sold for hundreds of millions of yen/dollars. This column will explain why NFTs are attracting so much attention, how they work, and how to use them.

What is an NFT?

NFT is an abbreviation for Non-Fungible Token, and like cryptographic assets (digital currencies), it is issued and operated using blockchain technology, a digital record-keeping system that is difficult to tamper with. NFTs can add value to digital contents, etc., whose originality or ownership could not be proven on the conventional Internet.

NFTs have the role of a certificate of proof or certificate of authenticity to show if the data being handled digitally is the “original,” ensuring that digital data has the same authenticity value as real physical works of art, making it an asset of value. This characteristic, which can prove inherent value, is already being used in cases such as trading of memberships and ownership of real estate, as well as proof of digital art and other works of art.

As of September 2021, the total market capitalization of the NFT market reached USD $14.19 billion/about JPY 1.5885 trillion (DappRadar estimate). Individuals, startups and organizations around the world have issued NFTs, and the market is expanding, especially in the NFT gaming industry.

NFTs, which have technical features not found in conventional tokens, are attracting a great deal of attention as they are expected to expand the use scenarios of the underlying blockchain and promote the digitization and simplification of all fields.

Need for NFTs and importance of them

One of the major reasons for the need for NFTs is the negative effects of digital reproduction. Unlike physical objects that are bought and sold in the real world, electronic data such as documents and artworks can be easily copied, making it difficult to distinguish between the original and the copy, and therefore the risk of misuse is high.

In this context, the recent growth of the crypto asset industry and the application of its underlying technology, blockchain, began to attract attention. The concept of NFTs came from the possibility that, if blockchain technology can be used as a means of proving digital data as a unique object, it can be linked to intangible digital works and their value as assets can be secured. NFTs originally became a hot topic in some circles from 2017 to 2018, but they are now gaining more attention due to the recent resurgence of the cryptocurrency industry.

Furthermore, the background of NFTs attracting attention is also related to big NFT news. For example, in March 2021, the NFT created by Twitter founder Jack Dorsey—his first post on Twitter—was sold for about JPY 300 million/USD$2.9 million, creating a huge worldwide buzz.

Earlier that month, another event that shook the art industry was the sale of digital artist Beeple’s artwork “Everyday: The First 5000 Days” at Christie’s, one of the world’s leading auction houses. The winning bid was a record-breaking USD $69.3 million/about JPY 7.5 billion. One of the reasons why NFTs are still attracting attention is because of the news about further successive high prices for digital artworks.

Differences between NFTs and Crypto Assets

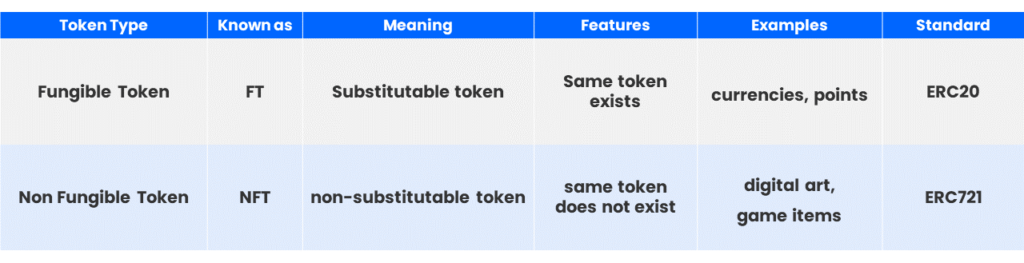

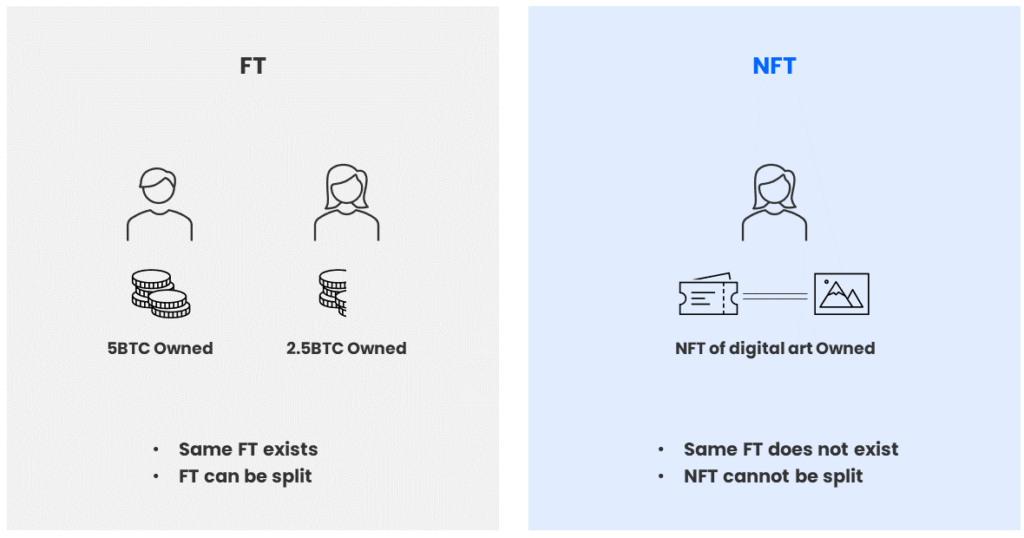

Bitcoin and other crypto assets are fungible tokens, which means that the existence of the token is treated as the same thing and can be replaced or divided. Other examples of substitutable tokens are legal tender, electronic money, stocks, and other things that have the same value and price if the quantity is the same.

On the other hand, NFTs, as the name implies, are tokens that are non-substitutable, meaning that no two tokens are the same and cannot be further divided. This applies to things that have their own unique character and value, such as real estate and land, which have different prices in different regions, and works of art, which are never the same. NFTs can be treated as unique objects that cannot be exchanged for other similar works by giving them asset value, including the identification information of the work or product. In fact, there are many examples of NFTs being used mainly in one-of-a-kind items such as game items and digital art because those things are compatible with the characteristics of an NFT.

How NFTs generate revenue and what fields are expected

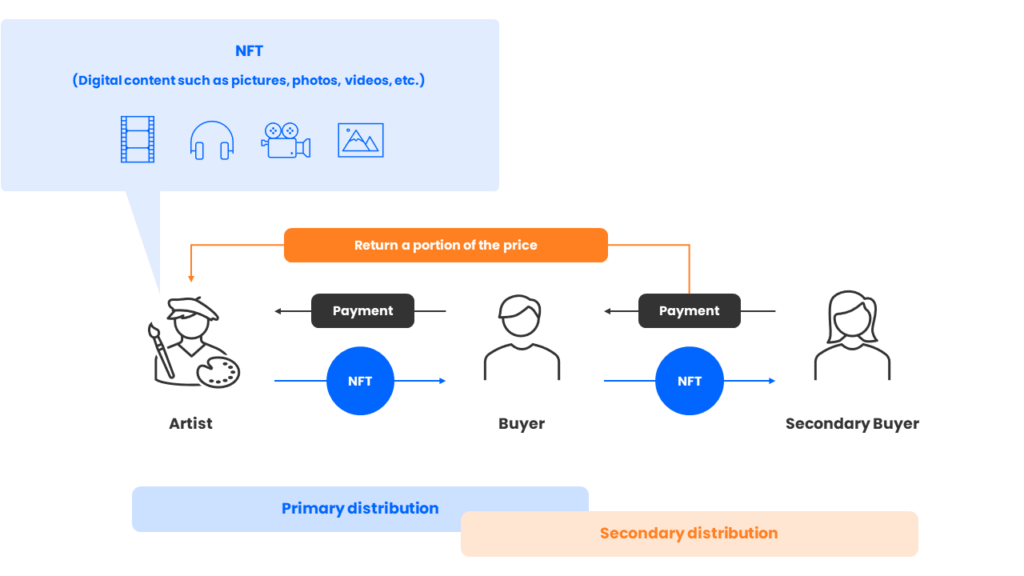

There are several markets where NFTs can actually be issued, but the basic approach is that the artist who created the original content records the details of the product on a dedicated platform and uploads it as an NFT. In addition, NFTs have a marketplace where a purchaser of that digital work can buy it and then later sell it to another person.

Normally, creators and manufacturers who develop and sell physical products only receive profits and sales at the time of sale, not through secondary distribution such as second-hand sales. However, with the NFT platform, a certain amount of money traded during resale will be returned to the original creators and manufacturers as royalties.

Further, by providing high traceability and falsification prevention of blockchain, which is the foundation of such tokens, NFTs can serve as a catalyst for copyright protection of artists’ works, utilization of IP (intellectual property) of contents, and secondary distribution of digital works, such as asset tracking and proof of authenticity.

In addition to the aforementioned examples of digital art, there are also examples of music copyright protection and digital land purchase through virtual reality (VR).

Concerns and cautions about NFTs: Can they achieve healthy development?

While there is a lot of attention and expectation on NFTs, some people are concerned about the problems and regulations of NFTs.

One concern is the many people who buy NFTs for speculation and resale, and some observers point out the bubble tendency in the background of the rise of the crypto market industry. Although the value of the traded works themselves is determined by the free will of the creators and the parties concerned, the primary distribution is conducted at prices that are not considered appropriate. In addition, since NFTs themselves are not substitutable in nature, there is no price benefit just by holding them, and profits are actually only generated during secondary distribution. Currently, the market is still in the process of developing compliance standards. However, transactions are being conducted with the expectation of price increases, and the trading value has reached a ceiling due to the heating up of the trading boom.

NFTs also pose the risk of reproduction. Even if a certificate of ownership or certificate of authenticity certifying NFTs cannot be forged, the data itself can be copied, and there have already been cases of NFTs being issued for unauthorized reproduction of digital art on the Internet. There is an urgent need to establish regulations on the secondary distribution of NFTs, such as setting clear screening standards for NFT issuers and companies that support the industry to prevent such misuse and violations.

We at CTIA are also proposing new businesses that make use of NFTs and are promoting DX based on blockchain technology. We will continue to propose solutions that meet the challenges and needs of the real world so that NFTs and blockchain, including fintech, can continue to have value.

Writer: Ogasahara